As much as I would like to say I know.

I dont... but...

Unless the commodities market is going to go into a bear market entirely on US President Trumps election, and subsequennt "expectations" of future reality, being "predictable"... and there'fore the path is laid...

Then I'd suggest the opposite.

I don't think Trump is setting out to be predictable as much as he is setting some intentions he intends to follow through with to back his word.

One of those is a return to the things that: "to make America great again".

To do that, hes going to need to:

- Empower Americas finance and that involves combatting inflation, setting interest rates at suitable levels for affordable US citizen finance (relates to inflation).

- Ensure US dollar reserve currency "meaning" (not just status) {i.e: what does it mean to be a reserve currency, if the nature of floated exchange rates is a relational "model"}

- Enforce the tarifs and controls nessissary for their country to dominate that economic battleground. (i have no doubt that he is serious about enforcing their "financial-borders")

In the past, the US has very carefully and deliberately interfered in metals (gold/silver) due to the threat of debasement of the floating fiat model, for the benefit of themselves (as the reserve currency) and the model which other countries have followed for ~60 years. I would not consider this monetary battle pointless now that crypto has entered the picture. however...

The "minting" of new bitcoin is not a threat (due to its cap), the growth of a variety of alternatives however is

not limited. and neither is it's relative value.

the increase of bitcoins relative value then, increases base money supply. and its now at a level that parabolic growth can cause the following problem:

what IF: 1 bitcoin were suddenly worth MORE, than any ATM or other bank count dispense or transfer?

such that: people came to large transitions like those for houses... and stopped transferring into currencies before trading it for the assets?

think NOT about the tax implications of that... but how M1 M2 and M3 money supply would become completely unhinged from any "monetary policy" or responsibilities where we HAVE elected governments and financial institutions that have for DECADES/CENTURIES been maintaining nations based on careful honing of their currencies and their economic statistics...

Since that is now at a level that it CAN threaten nation states,

and consumes the energy equivalent OF nations...

then I would consider it wise for those that we vote to have the power to make decisions that benefit democratic equality and preservation of value of hard work, to preserve the value of their currencies for which their nations people are paid. (not saying bitcoin doesn't have a place, but I believe that anyone who thinks that since ive worked all my life and not bought bitcoin that they're somehow entitled to my house, land and food, without having worked for the same society I have, and thats a globally connected society; are DEAD wrong.)

Compare to the effects of his last term in office.

Across a few different variables.

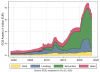

Increase in M0 money (yeah i know its ECB data...). VERY quickly was reflected in Bitcoin growth... excessively so.

As did global inflation... but what lagged?

Silver lagged, (gold also lagged)

As far as leading indicators go, and as far as stable movements go currencies relative value drop compared to Gold and silver, is more in line with CPI.

im expecting that the lagging nature of gold and silver is due to slow and stable growth that part of policy and tracking as part of the underpinning reserves.

if theirs going to be an problem with financial institution in the face of a rise in crypto where theirs a problem with "unbacked nature" of currencies...

then banks are able to increase the value of their underpinning assets, by simply valuing them higher. *(i.e the assets with which they have control, other than the currencies with which are floated...)

the same way as back and forth crypto trading is done to the greater fool... except gold is actually solid money as proven historically. and compared to its historic worth, the world has handled it at far greater cost to acquire that it is today.

It could be the RUM talking...

But i dunno man, makes enough sence to doubt it, and double check a few times...