Call me whacky , but I'm calling .

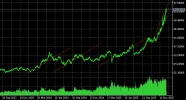

$1000 US an oz by the end of the year .

Mostly based on my geo mate & I can't / want give up too much information he feeds me .

But I will share what I can , I keep asking him for any technical reason for a major drop .

Big NO

Except

government can do what ever they want .

I'm buying irrelevant of price ,for now & had to borrow cash to pay for yesterdays purchase .

Discuss

Call me whacky ,call me mad .

I'm not selling until 1966 round 50's are $500 each .

Except any premium stuff that comes my way .

Could be $900 + not calling $1000 exactly but 10 fold roughly

foot note

" i've been wrong before & I'll be wrong again "

$1000 US an oz by the end of the year .

Mostly based on my geo mate & I can't / want give up too much information he feeds me .

But I will share what I can , I keep asking him for any technical reason for a major drop .

Big NO

Except

government can do what ever they want .

I'm buying irrelevant of price ,for now & had to borrow cash to pay for yesterdays purchase .

Discuss

Call me whacky ,call me mad .

I'm not selling until 1966 round 50's are $500 each .

Except any premium stuff that comes my way .

Could be $900 + not calling $1000 exactly but 10 fold roughly

foot note

" i've been wrong before & I'll be wrong again "