This has been discussed to death, and not everyone agrees (namely the numismatic collectors). However, I will tell you this:

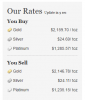

Buyback price offered will always be spot or a bit below. It all reverts to spot price. That goes for philharmonics, maples, eagles, Perth stuff, etc etc. Year doesn't matter, and country doesn't matter. Don't accept less than spot on govt bullion unless it is in very bad shape or you are in a real hurry to sell. You can typically sell govt bullion for spot quickly and easily if you sell it to other ppl yourself or find the right shop or dealer.

This is precisely why numismatic and collectible stuff with high premiums is silly in my opinion... a big waste of money as well as time. Sure, you might be able to search around and find the right buyers, but it is typically much work to sell small quantity. If you enjoy that work, then by all means... but don't expect to get rich doing it (unless you are the shop that buys the "numismatic" coins new from the mint @below spot). Could you hit a winner and buy a set that goes up in value? Sure. Is it likely? Much more likely to lose you the premium... and maybe silver spot price also. For every old set that has gone up, you will find many many many many that sell for roughly spot.

Generic silver stuff is a different story. That will typically get you spot minus roughly 5% or so... perhaps spot in a really good market. Brand name or art on the silver rounds or bars doesn't really matter (again, unless you want to search long and hard for a buyer who will pay for that particular stamp on a bar or cool looking demon on a silver round).

The difference between bullion and generic is liquidity as well as price. A coin shop or dealer will probably take more of the local country bullion... and may not want to buy foreign bullion or generic rounds at all. Keep that in mind when you are buying. To me, liquidity is worth something.

Prices you decide to pay are based on what you can find available to you.

Don't be in a hurry. Remember that you lose nothing by not buying. Make offers and if they're declined, you still have cash in your hand.

I would just tell you to never buy on credit (beyond stupid, but many ppl do it), get as close to spot as you can, and be patient.

Like any investment, PMetals are largely about emotional control. It is very good that you looked into selling process a bit before doing significant buying... go ahead and sell some once in awhile so you continue to learn; many people step in a huge hole by diving head first into stacking, overpaying on premiums, and not doing that sell price research early... they foolishly just believe the sticker prices they see when buying are what they'll sell their coins for. GL