Reverse of Gresham's law (Thiers' law)

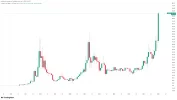

The experiences of

dollarization in countries with weak economies and currencies (such as

Israel in the 1980s,

Eastern Europe and countries in the period immediately after the collapse of the

Soviet bloc, or

Ecuador throughout the late 20th and early 21st century) may be seen as Gresham's law operating in its reverse form (Guidotti & Rodriguez, 1992) because in general, the dollar has not been legal tender in such situations, and in some cases, its use has been illegal.<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-22"><span>[</span>22<span>]</span></a>

Adam Fergusson (in:

When Money Dies) and

Costantino Bresciani-Turroni (in

Le vicende del marco tedesco, published in 1931) pointed out that, during the great

inflation in the Weimar Republic in 1923, as the official money became so worthless that virtually nobody would take it, people simply stopped accepting the currency in exchange for goods. That was particularly serious because farmers began to hoard food. Accordingly, any currency backed by any sort of value became a circulating medium of exchange.<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-23"><span>[</span>23<span>]</span></a> In 2009,

hyperinflation in Zimbabwe began to show similar characteristics.

Those examples show that in the absence of effective legal tender laws, Gresham's law works in reverse. If given the choice of what money to accept, people will accept the money they believe to be of highest long-term value and not accept what they believe to be of low long-term value. If not given the choice and required to accept all money, good and bad, they will tend to keep the money of greater perceived value in their own possession and pass the bad money to others.

In short, in the absence of legal tender laws, the seller will not accept anything but money of certain value (good money), but the existence of legal tender laws will cause the buyer to offer only money with the lowest commodity value (bad money), as the creditor must accept such money at face value.<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-Rowe-24"><span>[</span>24<span>]</span></a>[<em><a href="

https://en.wikipedia.org/wiki/Wikipedia:Reliable_sources" title="Wikipedia:Reliable sources"><span title="The material near this tag may rely on an unreliable source. blog posts are generally not reliable sources (November 2022)">unreliable source?</span></a></em>]

Nobel Prize winner

Robert Mundell believes that Gresham's law could be more accurately rendered, taking care of the reverse, if it were expressed as: "Bad money drives out good

if they exchange for the same price."<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-25"><span>[</span>25<span>]</span></a>

The reverse of Gresham's law, that good money drives out bad money whenever the bad money becomes nearly worthless, has been named "Thiers' law" by economist Peter Bernholz in honor of French politician and historian

Adolphe Thiers.<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-26"><span>[</span>26<span>]</span></a> "Thiers' Law will only operate later [in the inflation] when the increase of the new flexible exchange rate and of the rate of inflation lower the real demand for the inflating money."<a href="

https://en.wikipedia.org/wiki/Gresham's_law#cite_note-27"><span>[</span>27<span>]</span></a>