Not sure if anyone will get anything from these posts but perhaps it might pay off for someone.

This is how I made $10,000 this week. (This sounds like a pitch but it’s not, I don’t use products or gurus or special brokers and I don’t have advice for anyone).

My trades relate to cba and anz. But you can do this with many other shares and use any broker. I’ll post again later to say how the position is going.

This morning CBA opened steady around $99 and rose during the day to a peak of $100.65 before closing at $100.04.

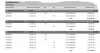

I sold 50 contracts of CBA2U7 $104 Nov 16 calls @ .87c = $4307 paid to me in cash into my bank tomorrow.

I also sold 50 contracts of Nov 16 CBA3J7 $106 calls @ .44c and an hour later another 50 @ .51c for about $4600 paid to me in cash into my bank tomorrow.

Earlier in the week, I sold 75 contracts of CBA3M7 $108 Nov 16 calls for .36c for a payment of about $2500 paid into my bank a few days ago.

Even though the cash will be paid into my bank it is not really mine until November 16, and these positions could go wrong.

I will get to keep all the money if the Commonwealth Bank shares stay below $104.

If the share price rises above $104 then I need to start thinking about rolling the position over to the next month, but that’s chapter 2.

But I make money if the bank shares fall, stay steady or rise a little bit.

The reason I’m posting this is to show how easy it is to make money when you have a reasonable belief that something is going to happen.

Your belief doesn’t need to happen for you to make money, it just needs to nearly happen.

I don’t think the Commonwealth Bank is going to go to $104 in the next six weeks and if it does go to $104, then I don’t think it will rise much more than that.

If you don’t already understand options you should probably not even try to learn. They are so risky.

But it would be great if there was other options traders here who were happy to bounce ideas around.

- the problem with owning gold or silver is that it doesn’t produce an income. But it’s fun to own.

- Shares are clearly a better investment because they appreciate in value and also pay an income - hopefully.

- Many people in this website are conspiracy theorists who have strong views about the end of the financial system as we know it.

- Exchange traded options are one of the very few places where you have more than a 50% chance of making money.

- Most people who trade options lose money.

- Only wealthy people with substantial share portfolios that consist of blue chip shares should consider trading options.

- Anyone who has strong beliefs about the collapse of the US dollar or anything else could put their money where their mouth is and make a fortune. You don’t need to be 100% correct - you just need to be not too wrong.

- There are ways to generate an income off holdings of physical gold and silver.

This is how I made $10,000 this week. (This sounds like a pitch but it’s not, I don’t use products or gurus or special brokers and I don’t have advice for anyone).

My trades relate to cba and anz. But you can do this with many other shares and use any broker. I’ll post again later to say how the position is going.

This morning CBA opened steady around $99 and rose during the day to a peak of $100.65 before closing at $100.04.

I sold 50 contracts of CBA2U7 $104 Nov 16 calls @ .87c = $4307 paid to me in cash into my bank tomorrow.

I also sold 50 contracts of Nov 16 CBA3J7 $106 calls @ .44c and an hour later another 50 @ .51c for about $4600 paid to me in cash into my bank tomorrow.

Earlier in the week, I sold 75 contracts of CBA3M7 $108 Nov 16 calls for .36c for a payment of about $2500 paid into my bank a few days ago.

Even though the cash will be paid into my bank it is not really mine until November 16, and these positions could go wrong.

I will get to keep all the money if the Commonwealth Bank shares stay below $104.

If the share price rises above $104 then I need to start thinking about rolling the position over to the next month, but that’s chapter 2.

But I make money if the bank shares fall, stay steady or rise a little bit.

The reason I’m posting this is to show how easy it is to make money when you have a reasonable belief that something is going to happen.

Your belief doesn’t need to happen for you to make money, it just needs to nearly happen.

I don’t think the Commonwealth Bank is going to go to $104 in the next six weeks and if it does go to $104, then I don’t think it will rise much more than that.

If you don’t already understand options you should probably not even try to learn. They are so risky.

But it would be great if there was other options traders here who were happy to bounce ideas around.