This is a simple example to show how the oft bleated 'wealth inequality' headline ignores some basic facts of life.

First: Age. Age has a large effect on wealth inequality. This can be shown by constructing a very simple stylised example. (Unfortunately this requires some primary school maths, but please try to keep up. )

)

Age distribution: To start with let's assume that we have a population of workers who are evenly distributed between ages 20-69. This conveniently means that a fifth of the working population is aged 20-29, a fifth is aged 30-39, and so on.

Incomes: Let's assume that the average 20-year old earns $20,000 per year and that as people age they acquire extra skills and rise gradually through entry level position to senior management such that their average salaries rise by $1,000 per year of age. Hence, 21-year olds earn an average of $21,000, 22-year olds earn $22,000 and so on until the average 69-year old earns an income of $69,000 a year. This is a very flat income distribution (but is presumably the goal of those who whine about wealth inequality).

Savings: For simplicity let's assume that every age group saves 5% of their annual salary. Which is invested in an accumulating portfolio.

Interest/dividends: Let's assume that the average rate of return on the portfolio is 5% per year (and assume it is credited the year after it is saved). For simplicity, I'll just call the investment returns 'interest'.

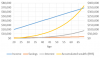

Based on these parameters, after one-year our 20-year old worker who has just entered the workforce has saved $1,000 (ie 5% of $20K). The next year they save a further $1,050 (ie 5% of $21K) and earn $50 interest on their previously invested $1,000. At the end of the year they now have accumulated wealth of $2,100.

The year after that our average 22-year old saves a further $1,100 (ie 5% of $22K) earns $105 on their investment portfolio of $2,100 and therefore by the end of the year has a wealth balance of $3,305.

Continue this year after year and by the age of 60, the average person is saving $3,000 (ie 5% of $60K), but has an accumulated wealth portfolio in excess of $200K that is earning $10,079.98 in interest. As a result of age the average 60-year old person has 200 times the wealth of our average 20-year old. Essentially through the power of compounding, the rate of wealth accumulation is exponentiating as people age and by the time they are 69 they'll have accumulated an average of $368,696 of wealth.

First: Age. Age has a large effect on wealth inequality. This can be shown by constructing a very simple stylised example. (Unfortunately this requires some primary school maths, but please try to keep up.

Age distribution: To start with let's assume that we have a population of workers who are evenly distributed between ages 20-69. This conveniently means that a fifth of the working population is aged 20-29, a fifth is aged 30-39, and so on.

Incomes: Let's assume that the average 20-year old earns $20,000 per year and that as people age they acquire extra skills and rise gradually through entry level position to senior management such that their average salaries rise by $1,000 per year of age. Hence, 21-year olds earn an average of $21,000, 22-year olds earn $22,000 and so on until the average 69-year old earns an income of $69,000 a year. This is a very flat income distribution (but is presumably the goal of those who whine about wealth inequality).

Savings: For simplicity let's assume that every age group saves 5% of their annual salary. Which is invested in an accumulating portfolio.

Interest/dividends: Let's assume that the average rate of return on the portfolio is 5% per year (and assume it is credited the year after it is saved). For simplicity, I'll just call the investment returns 'interest'.

Based on these parameters, after one-year our 20-year old worker who has just entered the workforce has saved $1,000 (ie 5% of $20K). The next year they save a further $1,050 (ie 5% of $21K) and earn $50 interest on their previously invested $1,000. At the end of the year they now have accumulated wealth of $2,100.

The year after that our average 22-year old saves a further $1,100 (ie 5% of $22K) earns $105 on their investment portfolio of $2,100 and therefore by the end of the year has a wealth balance of $3,305.

Continue this year after year and by the age of 60, the average person is saving $3,000 (ie 5% of $60K), but has an accumulated wealth portfolio in excess of $200K that is earning $10,079.98 in interest. As a result of age the average 60-year old person has 200 times the wealth of our average 20-year old. Essentially through the power of compounding, the rate of wealth accumulation is exponentiating as people age and by the time they are 69 they'll have accumulated an average of $368,696 of wealth.