You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Midnight to 6am - Overnight Spot Watchers Spot...

- Thread starter Turk

- Start date

Horse trading always ends in tears for someone. However none of us would consider gold or silver lame at this point and it would seem that many will surge back in once things stabilise. It should be quite possible that we will have a significant downturn in stocks this year at some point and it would be reasonable to expect a drop in metal prices if stocks turn down more than 15%.

Let see what happens.

Let see what happens.

Teh silvers

Active Member

Aye that is true...

Compaired with what we've endured duri'n the previous decade I still look back and wonder if anyone would believe how hard it truely was to living in this pirate vessle, travel'n... ney! voyaging... over these deadly sea's.

dealing with Kraken; working the oars 365 days a month, with only an empty bottle of rum to quench ones thirsts, and a dream...

Compaired with what we've endured duri'n the previous decade I still look back and wonder if anyone would believe how hard it truely was to living in this pirate vessle, travel'n... ney! voyaging... over these deadly sea's.

dealing with Kraken; working the oars 365 days a month, with only an empty bottle of rum to quench ones thirsts, and a dream...

And im low on dry powder.

No buying for me this pullback.

No buying for me this pullback.

$95.64 flushing out the weakies.

Im about to go down to my chicken coop. I'll see what they think about it.

I was expecting a pullback around $96 earlier but it blew right through it and said see ya.

Shanghai price is almost $140. How long before this is all bought up?

Im about to go down to my chicken coop. I'll see what they think about it.

I was expecting a pullback around $96 earlier but it blew right through it and said see ya.

Shanghai price is almost $140. How long before this is all bought up?

Wow, looks like nowhere to buy this morning - Perth Mint has bullion sales closed and Bullion Now only showing a few silver Tetris pieces and no gold. I can't even log-in to MyBullion. Looks like ABC is still selling, 10 oz bar at $1500.30 when spot is $118.00.

Last edited:

mybullion.com.au

Well-Known Member

Hey mate can confirm people have been logging in and placing orders this morning. PM me if you're still having issues and I'll assist.

Hope everyone weathered last night's historic drop OK.

More details to come in our monthly post scheduled for tomorrow

Hope everyone weathered last night's historic drop OK.

More details to come in our monthly post scheduled for tomorrow

Good to know, I’ll go have another try at logging in!Hey mate can confirm people have been logging in and placing orders this morning. PM me if you're still having issues and I'll assist.

Hope everyone weathered last night's historic drop OK.

More details to come in our monthly post scheduled for tomorrow

I suspect like Bullion List who appear to have stopped online sales outside of local business hours, Perth Mint don't want the risk of being cleaned out over a weekend in such a erratic market. Sometimes you have to step back, take breath, consider, re-adjust and prepare whether you are Perth Mint or a small bullion dealer.Wow, looks like nowhere to buy this morning - Perth Mint has bullion sales closed and Bullion Now only showing a few silver Tetris pieces and no gold. I can't even log-in to MyBullion. Looks like ABC is still selling, 10 oz bar at $1500.30 when spot is $118.00.

Ainslie, Jaggards and Bullion Money both appear open for online trade today but you'd be hard pressed to find anything with a normal 2025 premium attached.

KJC have closed their online sales from today. https://www.kjc-gold-silver-bullion...h9MOr9tRGfVIOA8ygzBFdRxctIb5aXCLiPIhEphXhXxkf

To be honest, I don't blame a dealer for slowing things down in this market. I think it'd be better to reduce sales and manage commodity $ risk than try and meet insane demand, cock up and find yourself highly negatively exposed in the current volatile.

Ghost Story

Well-Known Member

it really is a sign of the way the world is today so volatile.

Yef

Member

What an absolute massacre across the board. Stayed up late to watch it and seeing double digit falls between page refreshes had me checking different sources just to confirm what i was seeing was correct.

Trial by fire for those new to PM's and going to be hard to dca this weekend even if they wanted to.

Trial by fire for those new to PM's and going to be hard to dca this weekend even if they wanted to.

Crazy, alot of assets took a hit today. Good time to add to the stack maybe I dont know im broke.

I might have to sell one of my boats hehe jk.

I might have to sell one of my boats hehe jk.

Same here, It would have taken out every stop on the way down like a hot knife through butter.What an absolute massacre across the board. Stayed up late to watch it and seeing double digit falls between page refreshes had me checking different sources just to confirm what i was seeing was correct.

Trial by fire for those new to PM's and going to be hard to dca this weekend even if they wanted to.

I'm very interested in how $15T can get wiped out in metals on the news that someone got a new job.

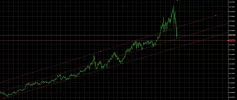

The way gold burst up through $5k USD was unbelievable.

It's just a shame that the volatility silver experienced on the way down was so excessive.

All the other fundamentals out the window now that theirs a different figurehead on the news to report what the otherwise same group of decision makers have plans for the future?

Yef

Member

The new hire was just the smokescreen needed by comex to pull their black magic fuckery. Shit has been lining up over the last few weeks with all the changes they have made.Same here, It would have taken out every stop on the way down like a hot knife through butter.

I'm very interested in how $15T can get wiped out in metals on the news that someone got a new job.

The way gold burst up through $5k USD was unbelievable.

It's just a shame that the volatility silver experienced on the way down was so excessive.

All the other fundamentals out the window now that theirs a different figurehead on the news to report what the otherwise same group of decision makers have plans for the future?

Im not the sharpest tool in the shed as even counting over 10 requires me to take my shoes off but what i do know is the human urge to corrupt anything and everything involving money is unstoppable. An asset with trillions of dollars market cap is just far too tempting to not have manipulation.

Market forces far beyond any impact retail can make will determine what all of our stacks are worth. Suppressing silver was obviously the play for many years but things have changed and comex gets to make changes as they wish.

Lock in some profits, sell a % to hold a free stack, DCA, convert some to gold or just hold. Having a risk strategy is vital in a time like this as all OHS features on this rollercoaster have been turned off.

"Lock in some profits, sell a % to hold a free stack, DCA, convert some to gold or just hold."

Probibly one for the "Exit Strategy" thread, but Thursday evening I was at "site redacted" taking photographs of various items in my stack so that I

could start posting some WTS threads on here this weekend!

I got the packing material and post bags, even had a post to spannermonkey before his WTB was fullfilled. then just...

Watching the price action like an stunned child, through the wire-like candles of the chart, like a fox was in behind the fence, feathers falling like snow in a blizard. By the time the misty morning fog had lifted I wondered... where was my silver eyed girl?...

Do you remember when; was it $174... (?147?)

ooh well, the delusional mind wont last, and at least I did an audit and know what I wanna keep and what I can sell further down the line.

By midnight I had a forex account re-created, and the ability to play a leveraged long a 1:30... and hesitation catching the knife at USD$101 and watched it kick through to $99... and decided... no... I am being irrational I didnt have a plan for this situation...

Woke up with sleep deprivation before the market actually closed for the weekend.

I dont know when I went to bed but im pretty sure I made it there by sleepwalking.

-------------------

"Some sweet sweet 10oz bars that would have been listed, If she was still above $160"

Probibly one for the "Exit Strategy" thread, but Thursday evening I was at "site redacted" taking photographs of various items in my stack so that I

could start posting some WTS threads on here this weekend!

I got the packing material and post bags, even had a post to spannermonkey before his WTB was fullfilled. then just...

Watching the price action like an stunned child, through the wire-like candles of the chart, like a fox was in behind the fence, feathers falling like snow in a blizard. By the time the misty morning fog had lifted I wondered... where was my silver eyed girl?...

Do you remember when; was it $174... (?147?)

ooh well, the delusional mind wont last, and at least I did an audit and know what I wanna keep and what I can sell further down the line.

By midnight I had a forex account re-created, and the ability to play a leveraged long a 1:30... and hesitation catching the knife at USD$101 and watched it kick through to $99... and decided... no... I am being irrational I didnt have a plan for this situation...

Woke up with sleep deprivation before the market actually closed for the weekend.

I dont know when I went to bed but im pretty sure I made it there by sleepwalking.

-------------------

"Some sweet sweet 10oz bars that would have been listed, If she was still above $160"

Last edited:

Teh silvers

Active Member

A part of me want to see $165 silver again. But a bigger part of me wants a crash to $20 so I can back up the truck.