minimilled

Active Member

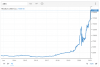

This was promising news for Rh a day or so ago

“Analysts say the supply/demand deficit for palladium will deepen this year as a result of a furnace explosion at an Anglo American Platinum plant, while the cutback will probably erase a surplus that had been expected for platinum.

One bank, BMO Capital Markets, issued a report early Wednesday hiking its price forecasts for platinum group metals in 2020.

Amplats, the world’s second-largest platinum producer, declared a force majeure Friday and cut its guidance for output of platinum group metals after an explosion resulted in the shutdown of Anglo Converter Plant processing facilities in South Africa.The explosion at a phase A unit occurred in February at the Waterval smelter. Original plans had been for a phase B unit to take over production, but water detected in the furnace meant the risk of another explosion, so the company shut down the plant, Amplats reported.”

““Our [forecasts for] rhodium prices for 2020 and 2021 have risen over 100%,” BMO said. The bank forecast $12,750-per-ounce rhodium this year, up 129% from a prior forecast of $5,563. The 2021 forecast was hiked to $8,625 from $4,000 previously. This metal was already priced high amid supply tightness.”

https://www.kitco.com/news/2020-03-...n-PGM-supplies-BMO-hikes-price-forecasts.html

BMO speculated future price prediction needs to be considered in terms of BMO’s failure to predict current price in the past and future, but also the unreferenced nature of their current quoted predictions, without qualification.

I’d say that mine failure is a bullish counterweight to matters at hand, regardless.

And also, it is hard to know precisely if you are not privy to the most important information.

“Analysts say the supply/demand deficit for palladium will deepen this year as a result of a furnace explosion at an Anglo American Platinum plant, while the cutback will probably erase a surplus that had been expected for platinum.

One bank, BMO Capital Markets, issued a report early Wednesday hiking its price forecasts for platinum group metals in 2020.

Amplats, the world’s second-largest platinum producer, declared a force majeure Friday and cut its guidance for output of platinum group metals after an explosion resulted in the shutdown of Anglo Converter Plant processing facilities in South Africa.The explosion at a phase A unit occurred in February at the Waterval smelter. Original plans had been for a phase B unit to take over production, but water detected in the furnace meant the risk of another explosion, so the company shut down the plant, Amplats reported.”

““Our [forecasts for] rhodium prices for 2020 and 2021 have risen over 100%,” BMO said. The bank forecast $12,750-per-ounce rhodium this year, up 129% from a prior forecast of $5,563. The 2021 forecast was hiked to $8,625 from $4,000 previously. This metal was already priced high amid supply tightness.”

https://www.kitco.com/news/2020-03-...n-PGM-supplies-BMO-hikes-price-forecasts.html

BMO speculated future price prediction needs to be considered in terms of BMO’s failure to predict current price in the past and future, but also the unreferenced nature of their current quoted predictions, without qualification.

I’d say that mine failure is a bullish counterweight to matters at hand, regardless.

And also, it is hard to know precisely if you are not privy to the most important information.

Last edited: