You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How low will Silver go during February? In USD

- Thread starter openeyes

- Start date

None of the above past Feb

All PMs will soon become COMMODITIES ONLY under the new world system we are going into , NESARA/GESARA ....... all PM prices past/present/future are not organic and are totally controlled by ..........

All PM shops will close in the new system .........

Under the new system I hear that GOLD price will range between USD $35-$50/oz and Silver range between USD $3.50-$5.00/oz

The above info is out there if you DYOR and know where to look

All PMs will soon become COMMODITIES ONLY under the new world system we are going into , NESARA/GESARA ....... all PM prices past/present/future are not organic and are totally controlled by ..........

All PM shops will close in the new system .........

Under the new system I hear that GOLD price will range between USD $35-$50/oz and Silver range between USD $3.50-$5.00/oz

The above info is out there if you DYOR and know where to look

Nice story .None of the above past Feb

All PMs will soon become COMMODITIES ONLY under the new world system we are going into , NESARA/GESARA ....... all PM prices past/present/future are not organic and are totally controlled by ..........

All PM shops will close in the new system .........

Under the new system I hear that GOLD price will range between USD $35-$50/oz and Silver range between USD $3.50-$5.00/oz

The above info is out there if you DYOR and know where to look

But who's going to mine gold/silver at those prices ?

Time to stack those aussie $200 gold coins for their face value.None of the above past Feb

...

Under the new system I hear that GOLD price will range between USD $35-$50/oz and Silver range between USD $3.50-$5.00/oz

-------------------------

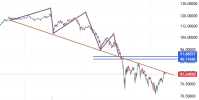

Im going to have a stab, and say that the Feb low will get as low, as 55-60. likely in an extremely quick spike down, due to some legitimately concerning news. (the effect of which is probibly already known in advance today by those that orchestrated the start of this fall ( attributed to stupid news of someone getting a job....) : and will otherwise be perplexing when the price doesnt stay low when the news that causing this flash crash event is annouced... )

Based on these 2 trends, one in the normal and one in the logarithmic scale. at the lows of the trending channel just before the cup and handle formation... and ultimately respecting that 2 month long cup and handle pattern.

But i could be wrong. it could respect the floor at 70, and/or take as long as march to make that second low. (by that stage probibly a little higher than 60)

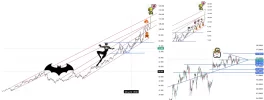

It didnt follow my mushroom run prediction, or reach my revised zelda love heart top.

And I never really understood why the cloud gap up from 90->91.5 (but that really blew out on the way down.)

So mabie that says something about this prediction too.

Last edited:

DJE

Well-Known Member

There’s a lot of “info” out there.The above info is out there if you DYOR and know where to look

We just need to decide what’s legitimate and what’s not.

Let me guess you’re still under the impression Trump is saving us and Q is real?

I believed that once upon a time but it was delusional thinking and hope more than anything else.

Each to their own and only time will tell.

Ghost Story

Well-Known Member

its hard to buy any metal atm not sure what that means but it's weird

Ghost Story

Well-Known Member

interesting and probably true but they do like taking our "money" when they are making a pile then shut it down when they are not which is fine but doesn't build confidence in the whole system.

Ghost Story

Well-Known Member

lot of people got burnt at this point with the bubble burst and want to cost average but can't? strange times ahead

Dealers dont NEED to be exposed to the value of their gold and silver holdings.

Its entirely possible for them to buy and sell their stack, fully hedged.

For example... i could right now, take a short out against my current stacks ASW value.

And the only profit or loss i make ongoing, would be in the premiums i could get...

And just begin trading like that.

Just have to make sure i cover the spread bid-ask in the premiums i get.

I could, in theory, aquire stacks on here at low premium at $170spot

And sell back to market today with a premium at $120spot

And be totally profitable.

Its their choise to be exposed, as it is yours.

Their profit as a businees. Has always been the difference between what they buy at and sell at.

So if they expose themseves to millions in potential loss by not hedging, or want to save the spread cost by only doing it 1ce a day.

Thats not really your problem, and it shouldnt be up to you paying a premium to cover their risk, when that "insurace" cost, is a tiny fraction of the premium their charging.

.01 of a contract is 50oz.

So they should be managing inventory to the 50oz threshold and never be expose more or less that 25oz to the up or downside eitherway at any time... optimally.

Any more details and ill have to sell my programming services in metatrader based automated trading as a quant.

Its entirely possible for them to buy and sell their stack, fully hedged.

For example... i could right now, take a short out against my current stacks ASW value.

And the only profit or loss i make ongoing, would be in the premiums i could get...

And just begin trading like that.

Just have to make sure i cover the spread bid-ask in the premiums i get.

I could, in theory, aquire stacks on here at low premium at $170spot

And sell back to market today with a premium at $120spot

And be totally profitable.

Its their choise to be exposed, as it is yours.

Their profit as a businees. Has always been the difference between what they buy at and sell at.

So if they expose themseves to millions in potential loss by not hedging, or want to save the spread cost by only doing it 1ce a day.

Thats not really your problem, and it shouldnt be up to you paying a premium to cover their risk, when that "insurace" cost, is a tiny fraction of the premium their charging.

.01 of a contract is 50oz.

So they should be managing inventory to the 50oz threshold and never be expose more or less that 25oz to the up or downside eitherway at any time... optimally.

Any more details and ill have to sell my programming services in metatrader based automated trading as a quant.

Ghost Story

Well-Known Member

interesting  why wouldnt they do that then?

why wouldnt they do that then?

im like super poor so its more like a hobby than anything else but dont say no to making a couple $ and no idea how markets work. always open to learn more tho.

The PM's speil is we cant keep up production if its anything like their website i sort of believe it lol

im like super poor so its more like a hobby than anything else but dont say no to making a couple $ and no idea how markets work. always open to learn more tho.

The PM's speil is we cant keep up production if its anything like their website i sort of believe it lol