You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

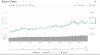

Call the Top for BTC 2017?

- Thread starter BuggedOut

- Start date

If it weren't for the tax liability headache it would create, I would be very tempted right now to set up some more exchange accounts and send some large international wires to arbitrage that difference.Australian exchanges seem to be in a massive hype, we are floating like 3-5k above what it should be, hit 22,967.00 today FFS

SilverDJ

Well-Known Member

Australian exchanges seem to be in a massive hype, we are floating like 3-5k above what it should be, hit 22,967.00 today FFS

And the difference between exchanges can be enough for worthwhile arbitrage.

TreasureHunter

Well-Known Member

This is crazy: it's almost 16,000

Now I too can imagine it can reach 50,000

Now I too can imagine it can reach 50,000

if you were unsure who is buying bitcoin https://www.bithumb.com/

already over $22k usd with over 2 billion in trades for the past 24 hours, hello korea

already over $22k usd with over 2 billion in trades for the past 24 hours, hello korea

Just saw there is a new Derivative exchange called BitMEX that's just popped up on coinmarketcap. It's doing more volume then any other exchange has done.

https://coinmarketcap.com/exchanges/bitmex/

https://www.bitmex.com/

Be careful people, the big boys are coming in and they see a MASSIVE once in a life time shorting opportunity. They pumped it up and they can deflate it all the way back down.

https://coinmarketcap.com/exchanges/bitmex/

https://www.bitmex.com/

Be careful people, the big boys are coming in and they see a MASSIVE once in a life time shorting opportunity. They pumped it up and they can deflate it all the way back down.

A$ 25000 by year's end !

This is the sort of rise that was expected of silver. Still waiting.

I see PMs like insurance if something goes wrong with the economy. If you want to make a lot of money you need to invest in riskier things like bitcoin, of course you can also lose a lot of money the same way. No risk no reward they say. Hard to see how investing in silver or gold will ever lose you a LOT of money (percentage wise) as they will always be worth a fair amount I think.

As for thread topic I could see Bitcoin being worth $30000 AUD the same way I could see it being worth $10000 .

I know I am going to regret saying this, but I reckon we have seen the top for the year. I call Cryptokitties as the sign of peak irrationality. When you are a crypto-millionaire who has made insane gains, paying $100,000 for a virtual cat doesn't seem as insane.

Bitcoin has $20 transaction fees, ethereum isn't doing much better - one dApp is enough to clog it up. I think that's a sign that valuations have run ahead of utility.

Bitcoin has $20 transaction fees, ethereum isn't doing much better - one dApp is enough to clog it up. I think that's a sign that valuations have run ahead of utility.

I would say utility was only a very minor consideration during this bull run, and only a consideration in FA eg IOTA or ripple and only to try and guess the next “good thing”.

Yes I agree, Bitcoin is more about an investment in this type of technology more than "is bitcoin going to be the only future". When it comes to digital currencies in the short term nothing is going to be stronger than bitcoin and there are a lot of rich people with too much government fiat wanting to diversify their investments.I would say utility was only a very minor consideration during this bull run, and only a consideration in FA eg IOTA or ripple and only to try and guess the next “good thing”.

If a $20 transaction fee is too much you shouldnt be investing in bitcoin, its more like a >$2000 investment type opportunity. Its increased like 3x in 2 weeks, if you were bought at the right times you are 3x richer in not much time. But in my opinion it should be treated more like a long term investment until something that looks to replace bitcoin is on the agenda. If you held since the dark days you are rich beyond belief and that is still possible right now imo. There are only ever going to be 21 million bitcoins created, and over a third of them are already destroyed which means the whole world demand is going for 14 million bitcoins.

Why would you think the whole world would want bitcoin? That's like people saying if everyone buys gold the price would be x amount. But everyone will never want gold, so it's a silly point. And bitcoin is an even weaker point then gold. Saying everyone will want bitcoin is like saying everyone will only want Perth Mint gold and no other stamp bar.the whole world demand is going for 14 million bitcoins.