Interesting times.

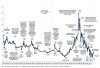

Below, are 4 Historical Charts of the S&P in each chart which provides a certain amount of correlation to our current S&P chart in (Red). The highest correlation is 91% to the 2008 Financial crisis, with the lowest being 1973 at 85%.

I have included a Poll and would like your opinion on which one is likely to play out.

In the Poll, I have chosen 1) as I still remain optimistic that the FED will cave in to the damage caused by interest rate increases, sooner rather than later, irrespective what Powell says.

What is your view?

Please vote.

Below, are 4 Historical Charts of the S&P in each chart which provides a certain amount of correlation to our current S&P chart in (Red). The highest correlation is 91% to the 2008 Financial crisis, with the lowest being 1973 at 85%.

I have included a Poll and would like your opinion on which one is likely to play out.

In the Poll, I have chosen 1) as I still remain optimistic that the FED will cave in to the damage caused by interest rate increases, sooner rather than later, irrespective what Powell says.

What is your view?

Please vote.