You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2nd US Bank failure!

- Thread starter bretto

- Start date

bretto

Active Member

This Bank is actually the 3rd! ...Silvergate was 2nd. not that we're counting1

This could be bigger than a Lehman moment. Interesting times.

Silvergate's demise was the result of a straightforward bet on cryptocurrencies, particularly large deposits and other business from crypto exchanges. FTX was one of the bank's largest customers. Silicon Valley Bank didn't bet heavy on crypto, but it mostly served tech startups in the region.

This could be bigger than a Lehman moment. Interesting times.

Silvergate's demise was the result of a straightforward bet on cryptocurrencies, particularly large deposits and other business from crypto exchanges. FTX was one of the bank's largest customers. Silicon Valley Bank didn't bet heavy on crypto, but it mostly served tech startups in the region.

Unfortunately with The Fed and Treasury's announcement that they will guarantee deposits above the FDIC's threshold limit, they're basically green-lighting risk and giving the cowboys free rein.

the money printing machines are going into overtime. Just got to finish the print run for ukraine 1stUnfortunately with The Fed and Treasury's announcement that they will guarantee deposits above the FDIC's threshold limit, they're basically green-lighting risk and giving the cowboys free rein.

Michael Kay

Well-Known Member

They are trying to make it look that way, Yellen etc...gov just letting everyone know who is in control.

So the narrative is that large banks are well-capitalised, and they will not be bailing out little guys like SVB. No more TBTF

Systemic risk may change that. Last few months have felt a bit like early 2008, rising IR, high fuel prices, tight real estate market. History doesn't repeat, but it can echo.

They are trying to make it look that way, Yellen etc...

So the narrative is that large banks are well-capitalised, and they will not be bailing out little guys like SVB. No more TBTF

Systemic risk may change that. Last few months have felt a bit like early 2008, rising IR, high fuel prices, tight real estate market. History doesn't repeat, but it can echo.

mission accomplished, close any crypto friendly bank and print money to make depositors whole, its simple.

everyone gets the printed cash, just dont take crypto again or we close you.

Michael Kay

Well-Known Member

So what do you think, Shiney? Actually a third bank, Signature Bank, just went down. I know that in the past you've claimed that liquidity crises and systemic risk are a thing of the past. I guess we will see how it all stacks up soon.The depositors should lose any funds above 250G.

Last edited:

florincollector54

Well-Known Member

Will be paying close attention to what happens Monday morning in the US. I suspect there may be some people who try to transfer money (if over 250k) from some of the smaller lenders to the larger banks.

I suspect there may be some people who try to transfer money (if over 250k) from some of the smaller lenders to the larger banks.

Another round of bank consolidations in play. The aim is to only have a few big guys with very tight integration. Makes the CB job a lot easier.

Another round of bank consolidations in play. The aim is to only have a few big guys with very tight integration. Makes the CB job a lot easier.

Yep, have to agree with you, there are far too many smaller banks in the USA and they want to get rid of as many of them as they can.

It will make the implementation of the CBDC on the sheeple a much easier task.

Unfortunately with The Fed and Treasury's announcement that they will guarantee deposits above the FDIC's threshold limit, they're basically green-lighting risk and giving the cowboys free rein.

This is the Fed trying to preempt a crisis of confidence leading to bank runs, especially at smaller deposit taking institutions.

The US banking landscape is hella fractured; thousands of small credit unions, mutual banks, saving societies etc. serving a specific local region operating on low reserves operating with almost non-profit margins.

(From Statisisa: In 2021, there were 4,236 FDIC-insured commercial banks in the United States.)

As for the 'moral hazard' arguments: Depositors are getting a 'bailout', not bank owners/shareholders. SVB and Signature Bank equity is still being wiped out, and most creditors to SVB & Signature will stand to lose they lent to SVB & Signature.

Last edited:

This is the Fed trying to preempt a crisis of confidence leading to bank runs, especially at smaller deposit taking institutions.

This is true but shiney is also right,cowboys in the industry will see this as a green flag to continue with the poor practices that are toxic

florincollector54

Well-Known Member

I tend to agree with you, although it should be noted that SVB and NY Signature Bank were very much on the inner, supporting the "right social/political causes" and public promoting their ESG policies.Another round of bank consolidations in play. The aim is to only have a few big guys with very tight integration. Makes the CB job a lot easier.

Last edited:

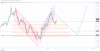

Fed Rate Pivot Is Back in Play

Markets are predicting a change in the course of interest rates now that there is trouble brewing in the banking sector.

The deal appears to be as follows: As of the time of writing, there isn’t a buyer for the whole bank (sidenote: HSBC buys SVB's UK arm). Instead, the Federal Reserve, US Treasury and Federal Deposit Insurance Corporation announced in a joint statement that all depositors will have access to their money as of Monday, and that no taxpayers’ money will be used. The statement suggests that any ultimate costs will be borne by other banks through the levy on them for deposit insurance: There will be no protection for holders of bonds or equities in the banks, and the senior management has been fired.

Meanwhile, the Fed will introduce a new acronym, the BTFP, which stands for Bank Term Funding Program, for which $25 billion is available. This will allow banks to borrow from the Fed using Treasury bonds as collateral and valuing them par. If the problem is solely one of liquidity rather than solvency, this should make a difference; banks are sitting on a lot of bonds whose value has tanked over the last year.

This doesn’t matter so much if they can hold them to maturity, but becomes a very big problem if they have to sell them for a loss — in such a situation the possibility of a death spiral such as UK gilts suffered last autumn would arise. If the existence of the BTFP serves to calm the banks’ clients down, it doesn’t have to commit the money; if the pressure intensifies, it might have to come up with much more than $25 billion. The effect is to ease financial conditions a bit. If all goes to plan, however, the outcome will be to make bank depositors (not just SVB’s) bear the bulk of the cost. That will ultimately be bad for banks’ profits, and therefore their shareholders.

https://www.bloomberg.com/opinion/a...runs-into-a-defi-wall?leadSource=uverify wall

Markets are predicting a change in the course of interest rates now that there is trouble brewing in the banking sector.

The deal appears to be as follows: As of the time of writing, there isn’t a buyer for the whole bank (sidenote: HSBC buys SVB's UK arm). Instead, the Federal Reserve, US Treasury and Federal Deposit Insurance Corporation announced in a joint statement that all depositors will have access to their money as of Monday, and that no taxpayers’ money will be used. The statement suggests that any ultimate costs will be borne by other banks through the levy on them for deposit insurance: There will be no protection for holders of bonds or equities in the banks, and the senior management has been fired.

Meanwhile, the Fed will introduce a new acronym, the BTFP, which stands for Bank Term Funding Program, for which $25 billion is available. This will allow banks to borrow from the Fed using Treasury bonds as collateral and valuing them par. If the problem is solely one of liquidity rather than solvency, this should make a difference; banks are sitting on a lot of bonds whose value has tanked over the last year.

This doesn’t matter so much if they can hold them to maturity, but becomes a very big problem if they have to sell them for a loss — in such a situation the possibility of a death spiral such as UK gilts suffered last autumn would arise. If the existence of the BTFP serves to calm the banks’ clients down, it doesn’t have to commit the money; if the pressure intensifies, it might have to come up with much more than $25 billion. The effect is to ease financial conditions a bit. If all goes to plan, however, the outcome will be to make bank depositors (not just SVB’s) bear the bulk of the cost. That will ultimately be bad for banks’ profits, and therefore their shareholders.

https://www.bloomberg.com/opinion/a...runs-into-a-defi-wall?leadSource=uverify wall