GreatWhiteBullion

New Member

Hi stackers,

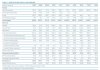

For the data addicts here, some interesting graphs on Silver Prices in AUD over the last half century. Hope you enjoy (took ages to compile the data). I know that there should be a second data set for the 20 years as a lot changes in 50 years…..but that will be for another day.

I’ve also gone to the liberty to invent a ratio to explain Silvers value vs average weekly earnings – called the Silver to Wage Ratio (SWR). (certainly exists somewhere else though)

Some basic information on the data:

The other important point is that these are individual comparisons against other Australian asset classes. This means that you can always make the two assumptions of silver vs the other asset, has it gone up or has the asset gone down etc. I will argue that say housing for example, it looks terrible for silver – but we could be seeing a time of housing prices reducing or stagnating vs silver. Time will tell, but I personally think the chart shows housing is overvalued vs silver, rather than silver losing a lot of value.

Interesting Data Points

If we could have a statistical reset or rebalancing towards averages In a nice perfect world, this is what would happen to these asset classes:

I have not put in long term returns of asset classes in % terms as this was more a look at relationships of local assets. But we all recognise that precious metals do well long term – just maybe not as well as some other things.

The last point I want to make is regarding the rising interest rate environment we find ourselves in as this is a hot topic regarding the recent fall in PM prices.

I can’t find the data source at the moment but there is a great statistical study looking at the correlation of gold and silver prices to periods of rising rates. Basically – the study found a very low correlation score that indicated its effectively random as to silver or gold prices going up or down when rates are rising. Just happens to be right now that prices are going down. What's important as you all know, is the longer term timeframes of prices.

For the data addicts here, some interesting graphs on Silver Prices in AUD over the last half century. Hope you enjoy (took ages to compile the data). I know that there should be a second data set for the 20 years as a lot changes in 50 years…..but that will be for another day.

I’ve also gone to the liberty to invent a ratio to explain Silvers value vs average weekly earnings – called the Silver to Wage Ratio (SWR). (certainly exists somewhere else though)

Some basic information on the data:

- Normalised to AUD to remove the USD exchange rate fluctuations for Silver/Gold as I wanted to have single variables to measure against.

- Data sourced from ABS, RBA and University of QLD. I had to do a lot of massaging of the data to align it.

- ASX200 data only goes back so far before it was only All Ords, so I’ve cut it off short to reflect this, otherwise the comparison is distorted to a smaller value index.

- House prices are an average of all capital cities (houses, not units). I had though about putting a modifier on Sydney due to it raising the median price so much, but thought against it.

- Average weekly pay level is that of an adult worker (male and female)

- All these charts can be flipped so that they are ratios of asset vs silver, rather than oz's of silver.

The other important point is that these are individual comparisons against other Australian asset classes. This means that you can always make the two assumptions of silver vs the other asset, has it gone up or has the asset gone down etc. I will argue that say housing for example, it looks terrible for silver – but we could be seeing a time of housing prices reducing or stagnating vs silver. Time will tell, but I personally think the chart shows housing is overvalued vs silver, rather than silver losing a lot of value.

Interesting Data Points

- Historically, Silver looks to be fairly valued right now when measured against average Weekly Pay, at 71.2oz per Week.

- Since 2010 Silver has averaged 25,720oz per Australian House, but the 52 year average of Silver Ounces Per House is 18,500. This shows an astonishing rise in value of the Median House price compared to Silver. When benchmarking against average pay, you could assume that housing is overvalued.

- Silver has averaged 290oz per share of the Aussie index, the ASX200 (XJO) over the last few decades. We are currently at 244oz Silver, which you could say means that silver is expensive or that the ASX200 is currently cheap. Looking at the average of silver compared to weekly pay, id say that the ASX200 is undervalued vs Silver. Again, just an assumption.

If we could have a statistical reset or rebalancing towards averages In a nice perfect world, this is what would happen to these asset classes:

- House prices would fall 30-50%.

- Gold would fall.

- ASX200 would rise.

- Silver would remain flat.

I have not put in long term returns of asset classes in % terms as this was more a look at relationships of local assets. But we all recognise that precious metals do well long term – just maybe not as well as some other things.

The last point I want to make is regarding the rising interest rate environment we find ourselves in as this is a hot topic regarding the recent fall in PM prices.

I can’t find the data source at the moment but there is a great statistical study looking at the correlation of gold and silver prices to periods of rising rates. Basically – the study found a very low correlation score that indicated its effectively random as to silver or gold prices going up or down when rates are rising. Just happens to be right now that prices are going down. What's important as you all know, is the longer term timeframes of prices.